Confidas Capital Advisors

Confidas Capital Advisors was created in 2004 as a platform for alternative investments. Since inception, it has completed over US$ 2.6 billion of co-investments in direct transactions and funds.

Leveraging its long track record of advising investors in many different asset classes, the platform developed a specialization in co-investments in U.S. real estate equity and debt.

U.S. Real Estate middle market debt investment thesis

Highly fragmented market with unique opportunities due to regulation

Background

Post 2008 financial crisis: traditional banks moved away from middle-market commercial real estate lending due to regulatory constraints.

Private debt space sees tremendous growth.

Small and mid-size borrowers seek alternative financing solutions.

Growth of independent private lenders in a fragmented market.

C.R.E

Properties used specifically for business or income-generating purposes.

The main classes of commercial real estate include: multi-family rentals; for–sale residential (condos); industrial; office and healthcare facilities.

Commercial real estate provides rental income as well as the potential for capital appreciation.

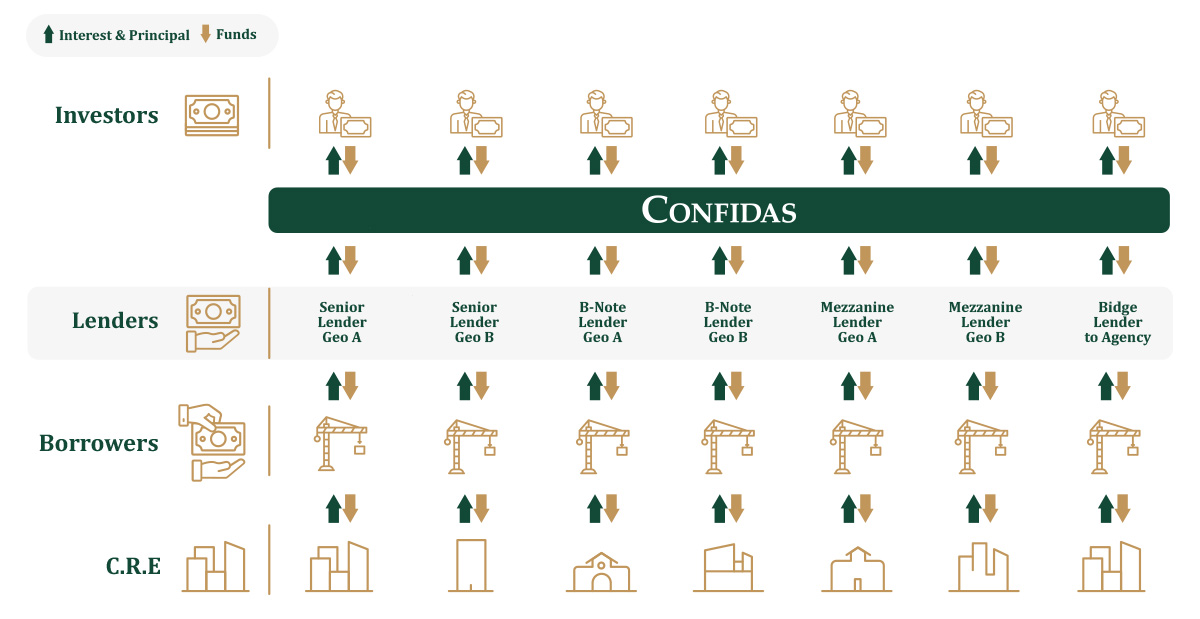

Confidas Lenders

Well established middle-market private lenders.

Co-invest minimum of 10% of each loan originated (“skin in the game”). Loan portfolios above $300 million.

Seasoned management and underwriting teams. 20+ years’ experience in CRE loan structuring / navigated economic cycles.

Well positioned to identify risks and generate strong returns for investors.

Potential For Attractive Returns with Excellent Collateralization

Borrowers

High quality real estate developers/operators with strong balance sheets providing significant guarantees.

Key criteria for borrowers’ lender selection: speed, certainty of close, non-recourse.

Loans

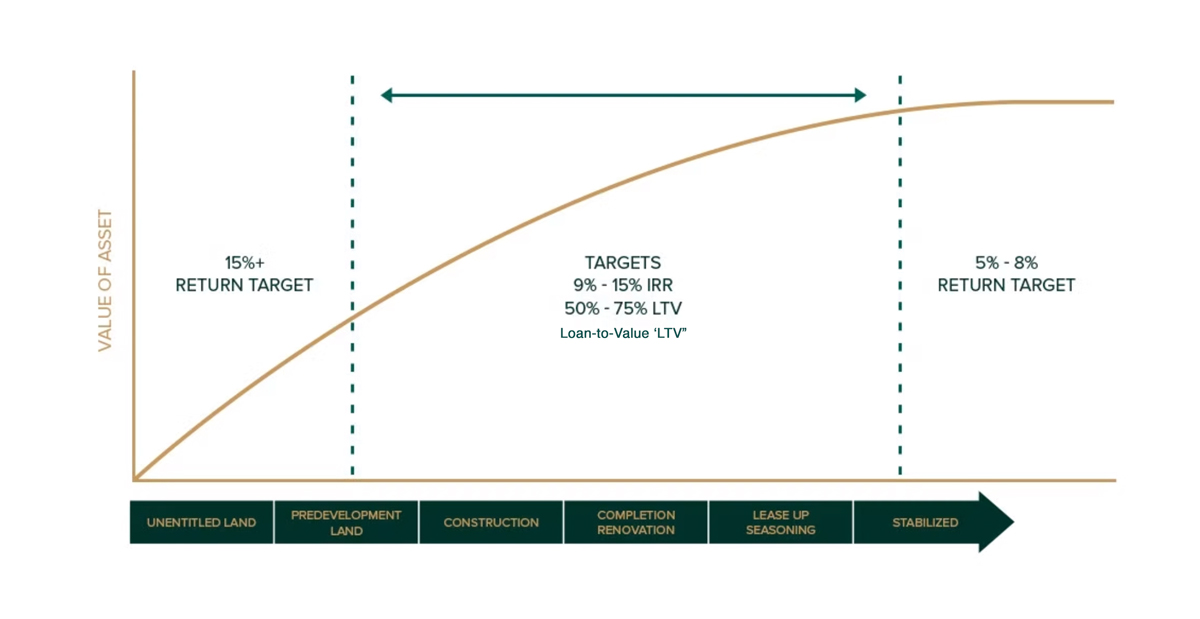

Value add/acquisition transitional bridge loans based on conservative loan-to-value (LTV) and loan-to-cost (LTC) ratios provide substantial downside protection.

Income

Most loans are current pay with monthly or quarterly income.

Potential for favorable taxation treatment for non-US investors.

Target Market: U.S. Real Estate Middle Market

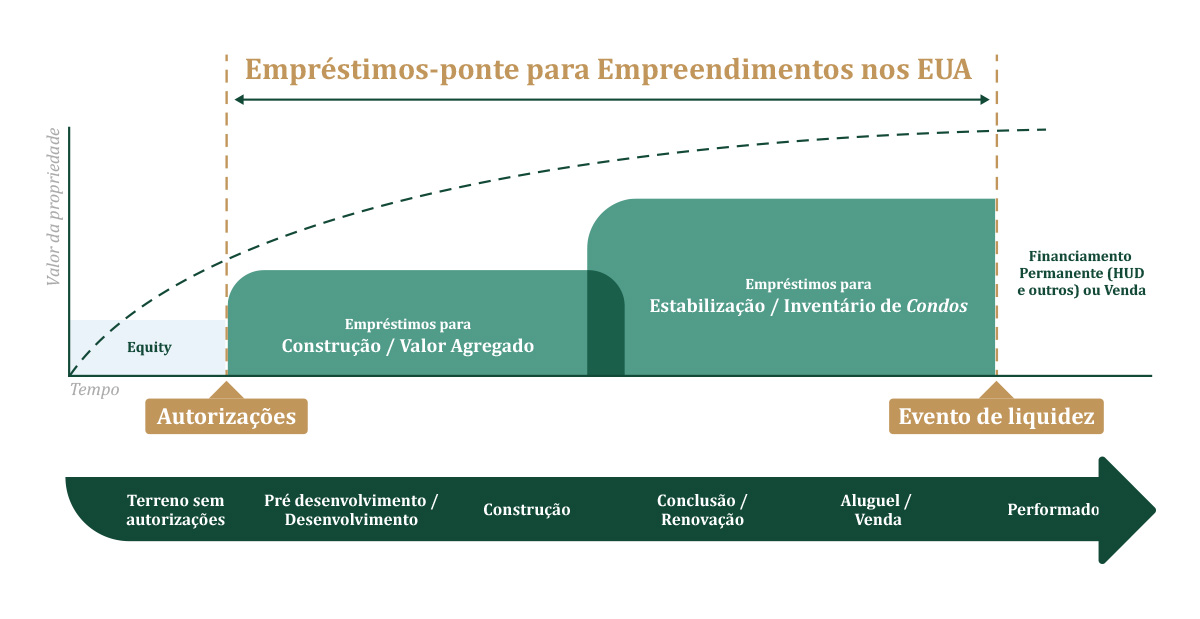

Assets which can benefit from bridge loans in order to maximize value prior to exiting into permanent facilities.

First mortgage and subordinated loans providing value add capital to transitional assets.

Commercial properties in major U.S. urban centers with high-quality sponsors.

Loan sizes: US$20 million to US$200 million.

Term: 12 – 36 months.

Confidas' unique added value is deep market knowledge and lender selection

…which combined with the strength of our relationships, allows us to source unique opportunities and develop attractive products for our investors

Confidas Process

Selection of Lenders

- Proven local knowledge & business acumen

- Distinguished track record including during stressed markets and in distressesd situations

- Co-investment capacity “skin in the game”

- Strong legal, market, investor references and crosschecks

- Internal loan servicing

Product Development

- Loan seniority

- Asset

- Geography

- Guarantees

- Duration

- Loan payoff-exit

Monitoring

Confidas follows each transaction closely

and develops a communication channel with investors to keep

them informed and ready

to make decisions if needed.

Exit

Although loans have short to medium term duration, investors may require an exit prior to maturity due to unforeseen circumstances.

Confidas actively assists in sourcing and closing secondary transactions.

U.S. Real State - Selected Transactions

Miami, FL

Development of Residential Condominium

Total Loan Size: $7.0M

Confidas investment: $7.0M

Loan To Cost (“LTC”): 42%

Term: 18 months with extension options

[mes_ano_propriedade]

Brooklyn, N.Y.

Construction Completion Loan

Senior Loan

Total Loan Size: $27.0M

Confidas co-investment: $2.2M

Loan To Value (“LTV”): 67%

Term: 12 months

[mes_ano_propriedade]

Boston, MA

Construction Loan

Mezzanine

Total Loan Size: $15,0M

Confidas co-investment: $2.0M

Loan To Value (“LTV”): 54%

Term: 30 months with extension options

[mes_ano_propriedade]

Los Angeles, CA

Refinancing and Completion of a Multifamily Development

Total Loan Size: $25.3M

Confidas co-investment: $1.5M

Loan To Value (“LTV”): 69%

Term: 15 months with extension option

[mes_ano_propriedade]

Midtown Manhattan, N.Y.

Condo Inventory Refinancing

Total Loan Size: $45.0M

Confidas co-investment: $6.4M

Loan To Value (“LTV”): 59%

Term: 20 months

[mes_ano_propriedade]

Stone Mountain, GA

Multifamily

Bridge-to-HUD Refinancing

Total Loan Size: $32.0M

Confidas co-investment: $2.6M

Loan To Value (“LTV”): 71%

Term: 18 months

[mes_ano_propriedade]

Delray Beach, FL

Hotel Construction Refinancing

First Mortgage Loan

Total Loan Size: $85.8M

Confidas co-investment: $3.0M

Loan To Value (“LTV”): 67%

Term: 23 months with extension options

[mes_ano_propriedade]

Conover Street Brooklyn, N.Y.

Residential Condominium

Senior B Note Construction Loan

Total Loan Size: $19.3M

Confidas co-investment: $3.0M

Loan To Value (“LTV”): 66%

Term: 17 months with extension options

[mes_ano_propriedade]

Centre Avenue Pittsburgh, PA

Mixed-Use Multifamily and Retail

Construction and Stabilization

First Mortgage Loan

Total Loan Size: $33.3M

Confidas co-investment: $3.0M

Loan To Value (“LTV”): 63.7%

Term: 16 months with extension options

[mes_ano_propriedade]

Brooklyn, N.Y.

Multifamily Rental Development

Co-Investment with Project Developer

Total Equity: $25.1M

Confidas co-investment: $18.2M

Construction completed: 1Q. 2023

[mes_ano_propriedade]

Biscayne Blvd Miami, FL

Condo Inventory

Senior B Note + Mezzanine Loan

Total Loan Size: $36.0M

Confidas co-investment: $3.5M

Loan To Value (“LTV”): 60%

Term: 12 months with extension options

[mes_ano_propriedade]

Shore Road, Gleenwood Landing, N.Y.

Residential Condominiums

Construction and Sell-Out

First Mortgage Loan

Total Loan Size: $59.6M

Confidas co-investment: $3.0M

Loan To Value (“LTV”): 66.7%

Term: 11 months with extension option

[mes_ano_propriedade]

Second Avenue New York, N.Y.

Mixed-use for Sale

Ground-up Development

Senior B Note Loan

Total Loan Size: $10.0M

Confidas co-investment: $6.0M

Loan To Value (“LTV”): 66.5%

Term: 36 months with extension option

[mes_ano_propriedade]

Franklin Street New York, N.Y.

Tribeca Condominium Ground-up Development

Mezzanine Loan

Total Loan Size: $13.5M

Confidas co-investment: $12.5M

Loan To Value (“LTV”): 66%

Term: 36 months with extension option

[mes_ano_propriedade]

28th Street New York, N.Y.

Mixed-Use Residential Condominium Construction and Sell-Out Financing First Mortgage Loan

Total Loan Size: $22.5M

Confidas co-investment: $5.0M

Loan To Value (“LTV”): 68.4%

Term: 24 months with extension option

[mes_ano_propriedade]

Fifth Avenue New York, N.Y

Mid-Construction Hotel

Senior B Note Loan

Total Loan Size: $25.0M

Confidas co-investment: $2.0M

Loan To Value (“LTV”): 54%

Term: 24 months with extension option

[mes_ano_propriedade]

Silicon Valley San Jose, CA

Partially Built Residential Condo

Complete Construction and Sell-Out

First Mortgage Loan

Total Loan Size: $41.9M

Confidas co-investment: $4.0M

Loan To Value (“LTV”): 60.8%

Term: 24 months with extension option

[mes_ano_propriedade]

Silicon Valley Fremont, CA

Partially Built Residential Condo

Complete Construction and Sell-Out

First Mortgage Loan

Total Loan Size: $45.0M

Confidas co-investment: $6.5M

Loan To Value (“LTV”): 61%

Term: 18 months with extension option

[mes_ano_propriedade]

West End Avenue New York, N.Y.

Multifamily (rental)

condo conversion

Mezzanine Loan

Total Loan Size: $55.0M

Confidas co-investment: $4.5M

Loan To Value (“LTV”): 65%

Term: 36 months with extension option

[mes_ano_propriedade]

Calvert Rd. Harrison, N.Y.

Luxury Multifamily Rental

Construction and Stabilization

First Mortgage Loan

Total Loan Size: $20.0M

Confidas co-investment: $5.0M

Loan To Value (“LTV”): 60.6%

Term: 30 months with extension option

[mes_ano_propriedade]

Livingston St. Brooklyn, N.Y.

Hotel Construction and Stabilization First Mortgage Loan

Total Loan Size: $29.0M

Confidas co-investment: $5.5M

Loan To Value (“LTV”): 54.7%

Term: 24 months with extension option

[mes_ano_propriedade]

Senior Housing Portfolio Northeast & Midwest U.S.

11 Properties in Development, Construction and Lease-up

Collateralized Bridge Loan

Total Loan Size: $8.0M

Confidas co-investment: $8.0M

Term: 24 months with extension option

[mes_ano_propriedade]

Malibu, CA

Mixed-use development

Repayment of Existing Debt & Funding of Predevelopment Costs

First Mortgage Loan

Total Loan Size: $38.3M

Confidas co-investment: $2.0M

Loan To Value (“LTV”): 60%

Term: 33 months

[mes_ano_propriedade]

West 81st Street New York, N.Y.

Condo Ground-up Development

Senior B Note Loan

Total Loan Size: $7.0MCo

nfidas co-investment: $2.8M

Loan To Value (“LTV”): 59%

Term: 30 months with extension option

[mes_ano_propriedade]

West Village New York, N.Y.

Townhouse and Condo Development Mezzanine Loan

Total Loan Size: $15.5M

Confidas co-investment: $11.3M

Loan To Value (“LTV”): 61%

Term: 24 months with extension option